For tax purposes, the IRS has specified fixed asset lifespan depending on what kind of fixed assets they are. Again, speak with your CPA about what was purchased in order to have all the startups entered accurately, as well as to get the help in setting up a depreciation schedule. Depreciation is generally for tangible items such as buildings, equipment, computers, furniture, vehicles, etc. If there are technology equipment such as computers or furniture in the initial purchases, you will need to separate them if they are used in the business, since they will need to be depreciated. It is always important to consult a CPA prior to booking startup costs. Fortunately, amortization is generally a straight-line process you take the costs and divide them by the number of years and expense by that portion. They are usually intangible costs like legal fees, government filing fees and the likes. Initial costs – market research, advertising the future opening of your business, salaries for training employees before the business opened, incorporation costs, trademarks and the likes are startup costs.Īs for amortization, that’s just a fancy accounting term accountants like to use when they refer to the process of spreading costs out to more than one year. Startup costs are those expenses that were incurred prior to the start date of the business, and are amortized over a number of years so they are not a total expense in the first year.

What are Startup Expenses or Costs?īefore we get into the above, let’s start off with the main question: What are startup expenses or costs? Not everything is a startup cost and to determine what is and isn’t a startup cost we have to look at whether the costs were incurred prior to the start date of the business ( costs to be amortized) or subsequent to the start date of the business ( costs to be expensed). The way in which these startup expenses are entered will depend on how the owner wants to treat them – loan or investment, the way the business is structured – Sole Proprietor or Single Member LLC, Partnership or Multi Member LLC, or Corporation, as well as when these expenses were incurred. I'd be delighted to help.How to Enter Startup Costs or Expenses Paid for With Owner’s Personal Moniesīy Marie | | Bookkeeping 101, Business Types & Accounting, Chart of Accounts Setup & Management, Personal and Business Expenses, QuickBooks for Mac, QuickBooks for Windows, QuickBooks Online, Reimbursements and Investments Let me know in the Reply section below if you have additional queries about upgrading your QBSE account. This way, we'll have the option to keep both accounts or either one of them. Once done, your QBSE sends your data directly to TurboTax Self-Employed so we can start filing your business taxes.įurthermore, here's an article if we'll need to send data from QBSE to TurboTax Self-Employed using a different username and password: Send QuickBooks Self-Employed tax data to TurboTax Self-Employed using different sign-in info.

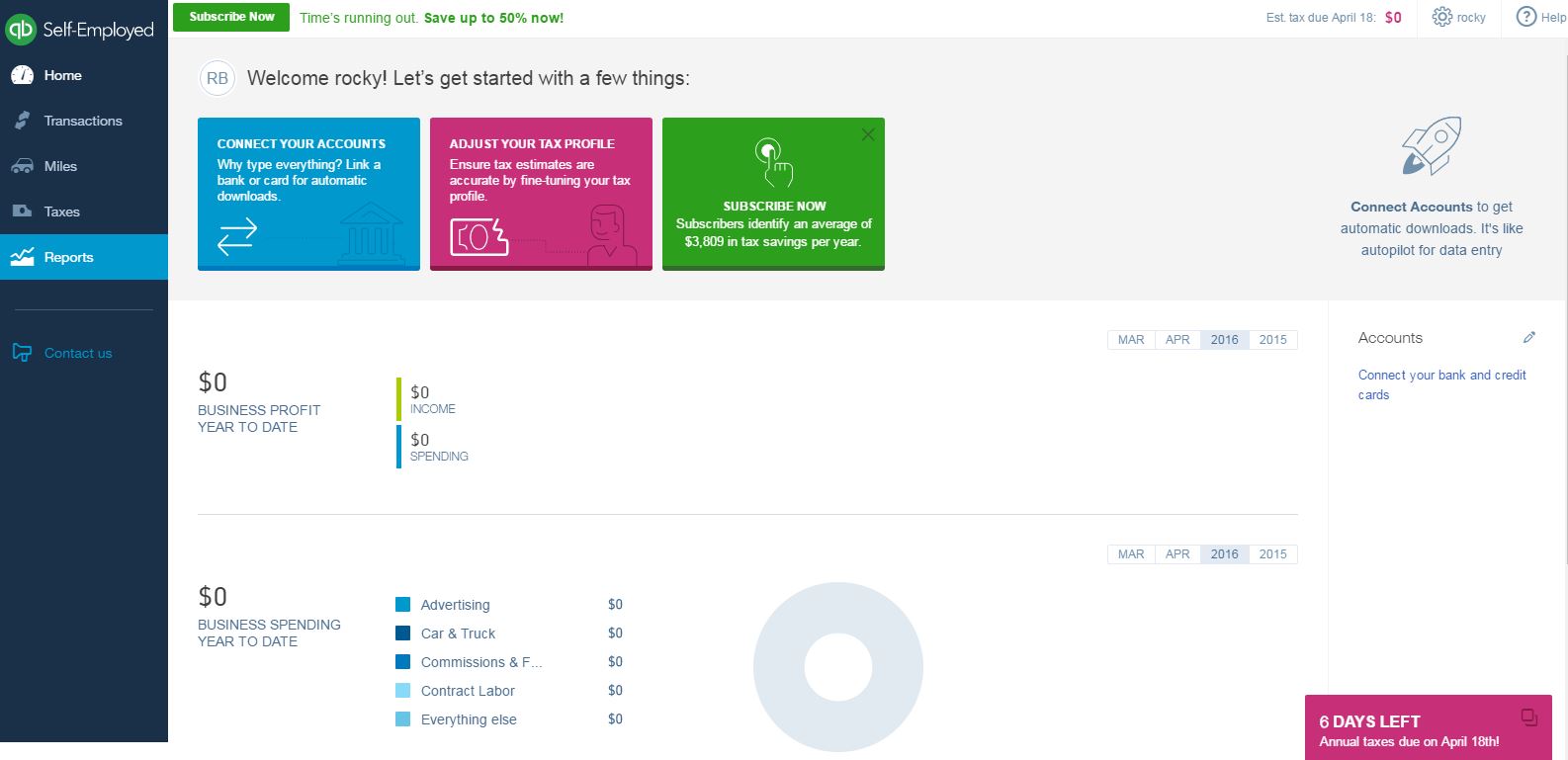

Swipe left and select Change subscription now.Select your profile icon and click Subscription.After that, we can cancel your QuickBooks Self-Employed subscription and resubscribe to the Tax Bundle. If we don't see this option, we'll have to wait until your subscription's next renewal date.

QUICKBOOKS SELF EMPLOYED FOR LLC UPGRADE

To avoid overlapping payments, you may want to upgrade after your existing QBSE subscription expires. It allows you to easily send your Schedule C data to TurboTax to file your taxes. The TurboTax Self-Employed is intended for independent contractors and self-employed individuals. When you upgrade your current plan to the Tax Bundle, you'll receive both apps. Thanks for taking the time to reach out to the QuickBooks Community for assistance, Let me help you upgrade your QuickBooks Self-Employed (QBSE) subscription using a mobile phone, as suggested by your accountant.

0 kommentar(er)

0 kommentar(er)